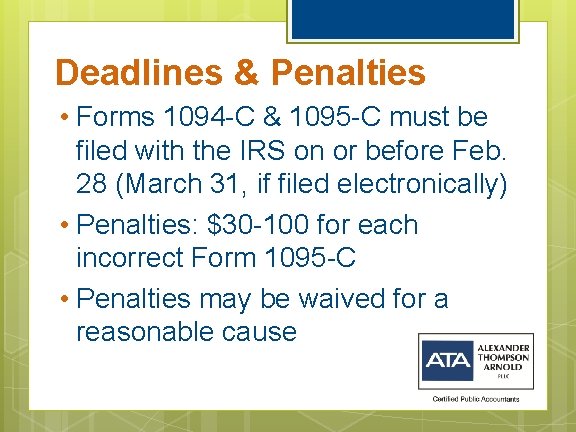

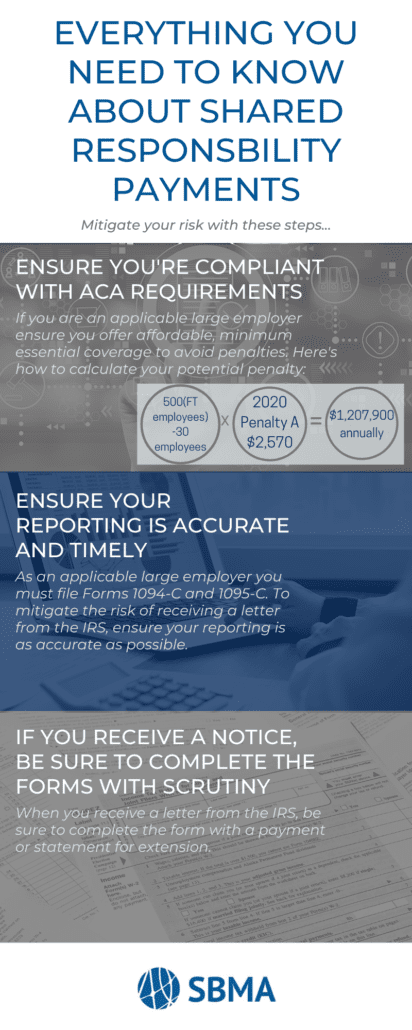

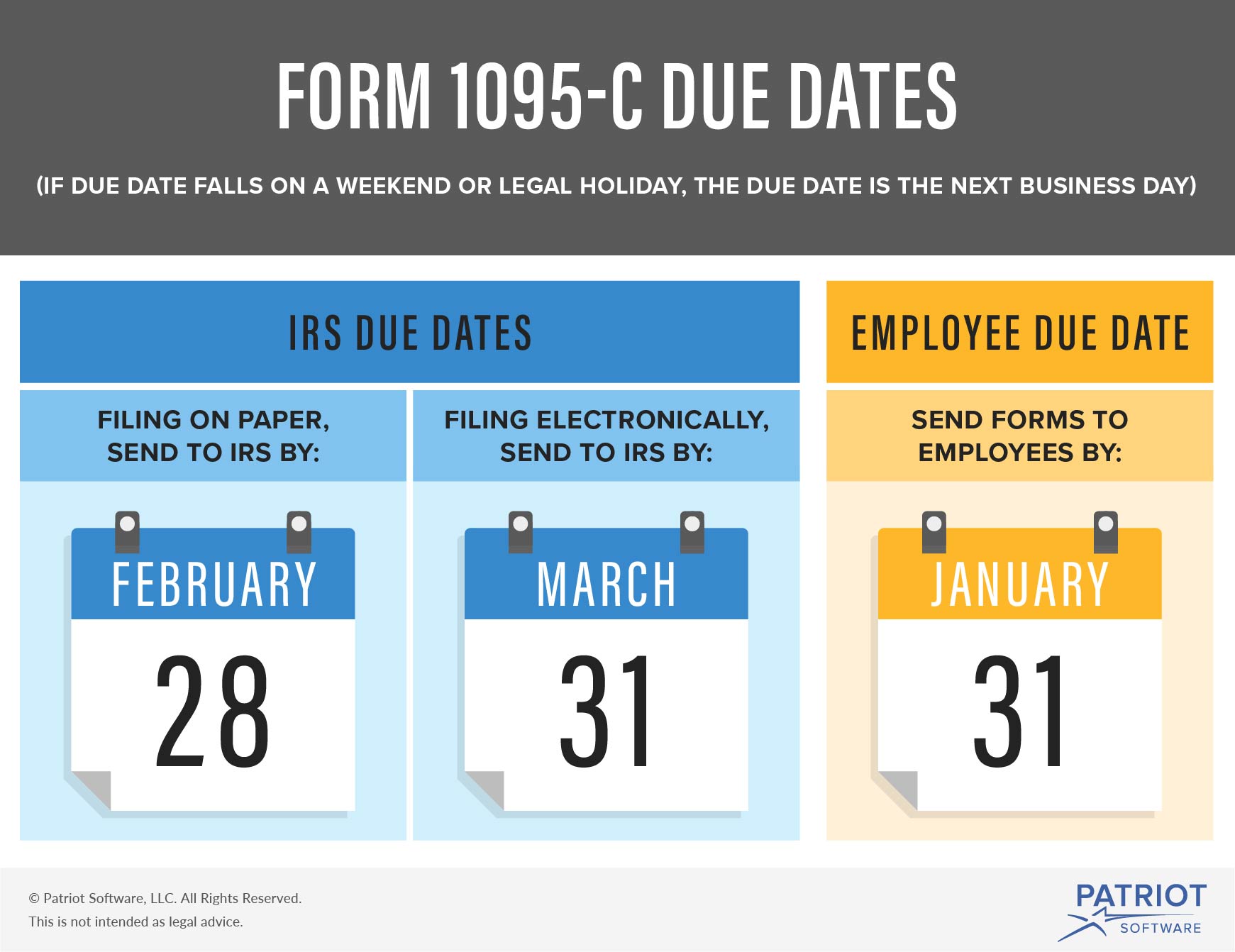

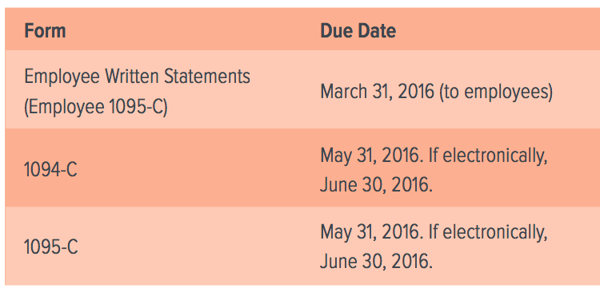

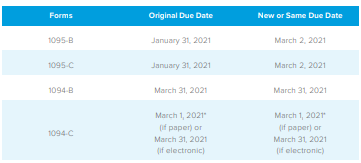

The original deadline for ALEs to file forms 1094C and 1095C with the IRS remains February 28 However, if an organization chooses to file the forms electronically, the deadline for submission is April 1 Common Errors While most ALEs have racked up experience with these filings by now, errors are still a possibilityThe Statute of Limitation and the Section 6721 Penalties For California purposes, federal Forms 1094C and 1095C must be filed by March 31 of the year following the calendar year to which the return relates Federal Form 1095C must be provided to the employee and any individual receiving MEC through an employer by January 31 of the year following the calendar year to which the return relates

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

1094-c and 1095-c penalties

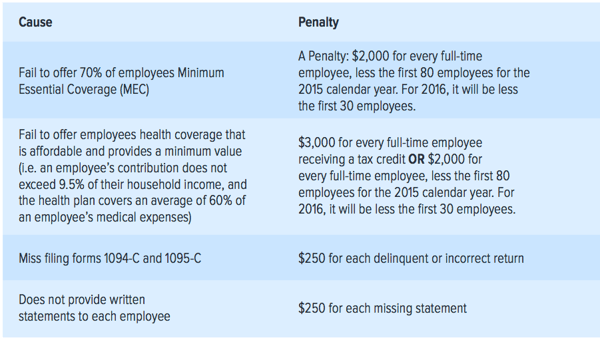

1094-c and 1095-c penalties- An employer of more than 50 employees also is required to file PPACA health care coverage forms 12 Assume the employer of 15,000 people fails to file Forms 1094C and 1095C for all of its employees 13 The penalties for Forms 1094C and 1095C are calculated as follows Tier 1 — forms filed on or before March 28 $50 × 15,000 = $750,000What is Form 1094C?

The Irs Wants To Know Has Your Company Filed Form 1095 C

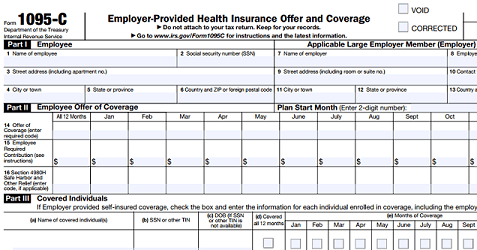

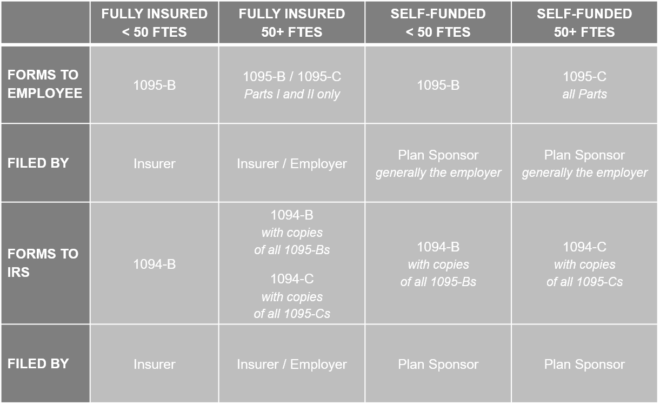

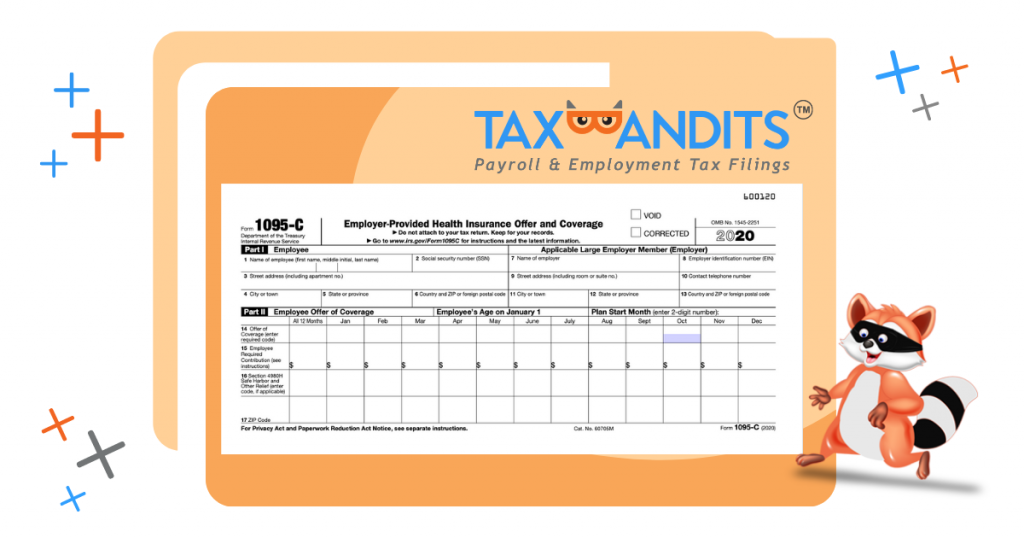

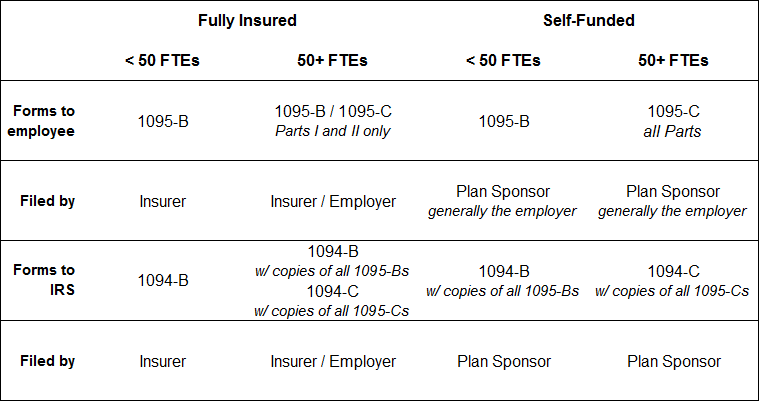

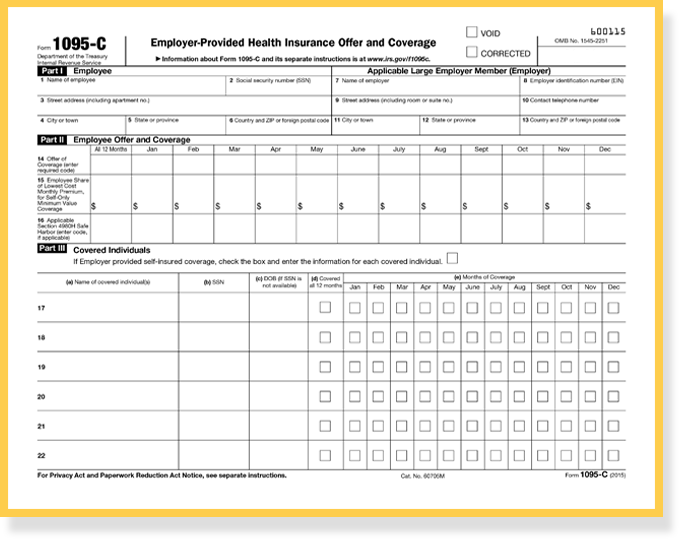

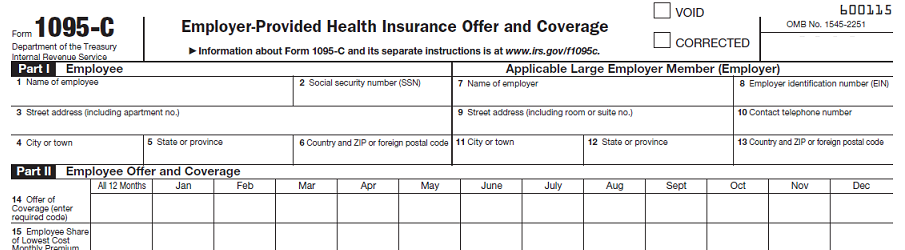

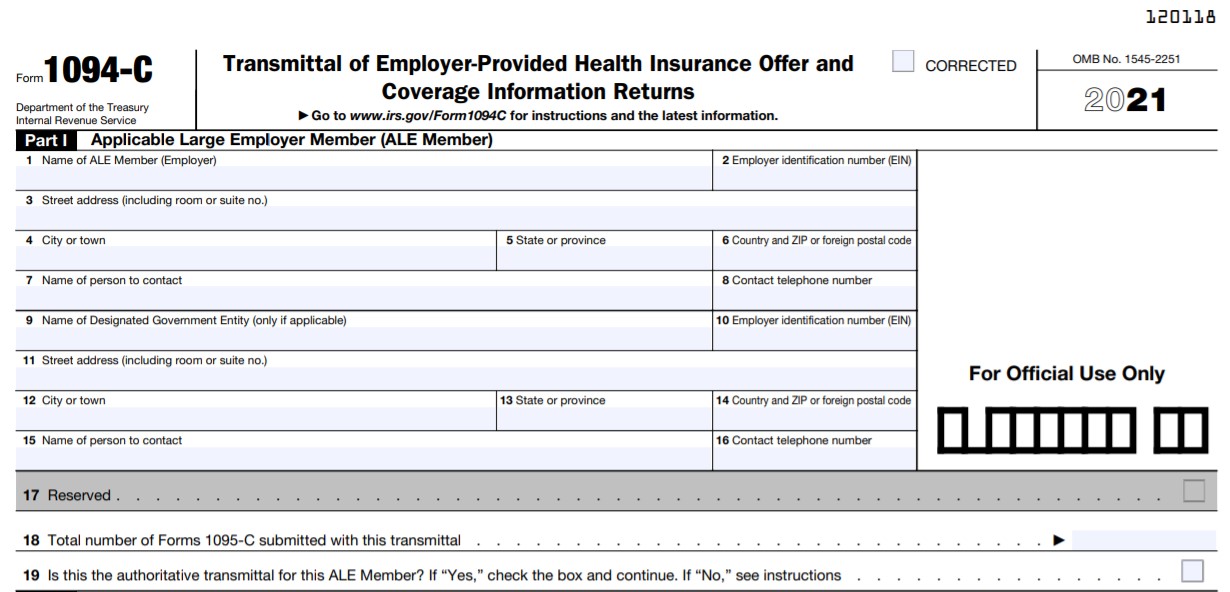

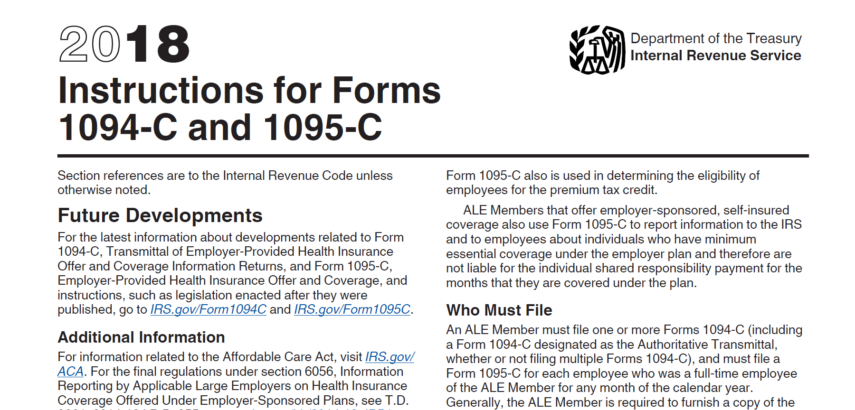

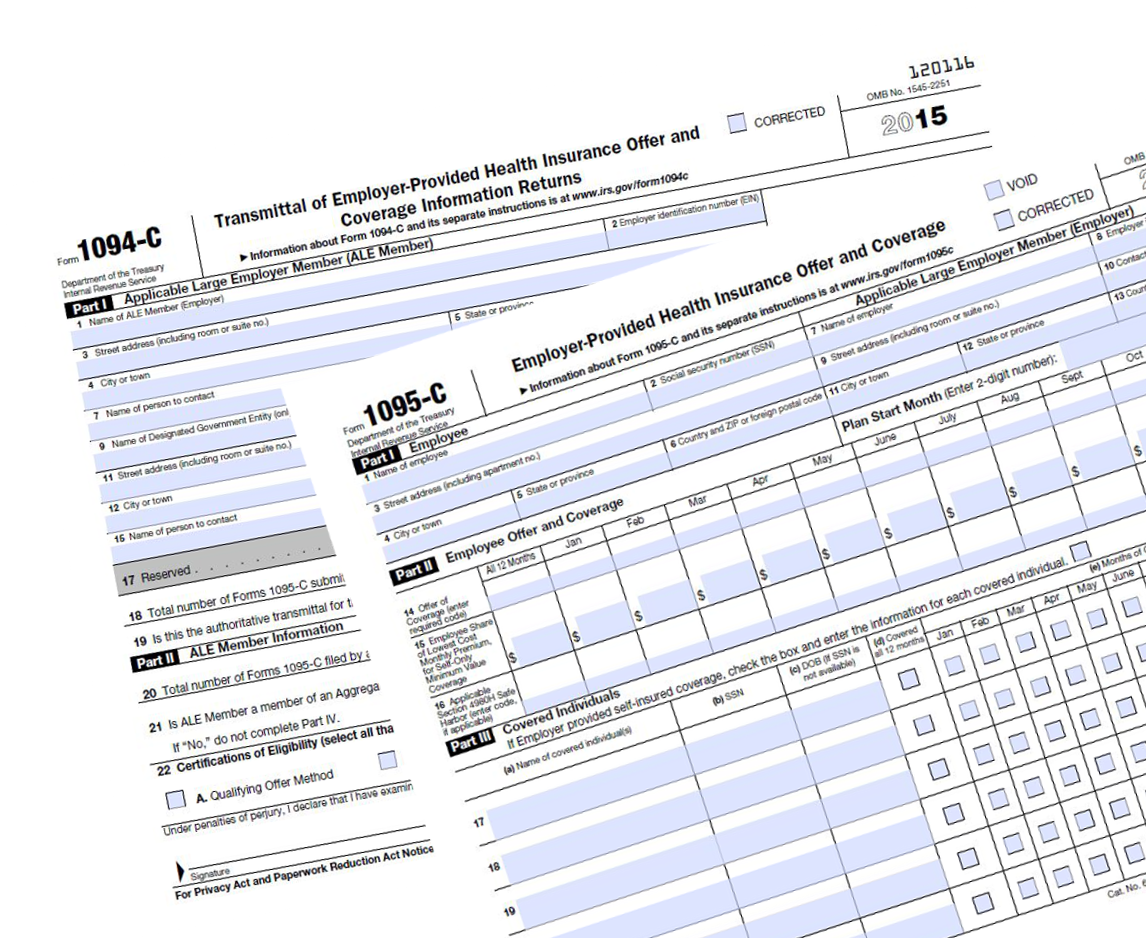

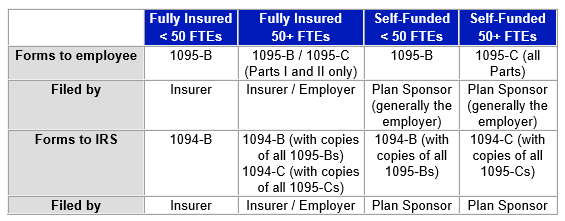

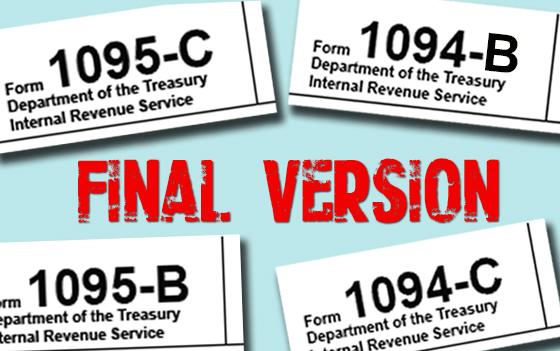

Final 15 Form 1095C, Instructions, Electronic Filing Steps Beginning with calendar year 15, an applicable large employer ("ALE") must use Forms 1094C and 1095C to report the information required under Internal Revenue Code sections 6055 and 6056 about offers of health coverage 1095 – C is like a W2 Each employee must receive a 1095C from the employer and a copy is also submitted to the government 1094C is like a W3 Aggregate of all 1095C data This file is submitted either electronically or via mail to the government First 1094C Filing is (March 31st if filed electronically) IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095C

This information is filed on Forms 1094C and 1095C If businesses do not furnish or file this information accurately and timely, they might be subject to reporting penalties In addition, for selfinsured ALEs, the forms include reporting on individuals covered under the employer plan What happens if an ALE does not file a 1094C/1095C on time? Employers need to submit an annual report to the IRS to avoid penalties To submit the annual report, organizations must file Form 1094C and 1095C Any mistake to these forms may cause serious troubles for employers The IRS updates the instructions for filing Forms 1094C and 1095C almost every year An Applicable Large Employer (ALE) must use Forms 1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees Generally, employers with 50 or more fulltime employees (including fulltime equivalent employees) in the preceding calendar year are

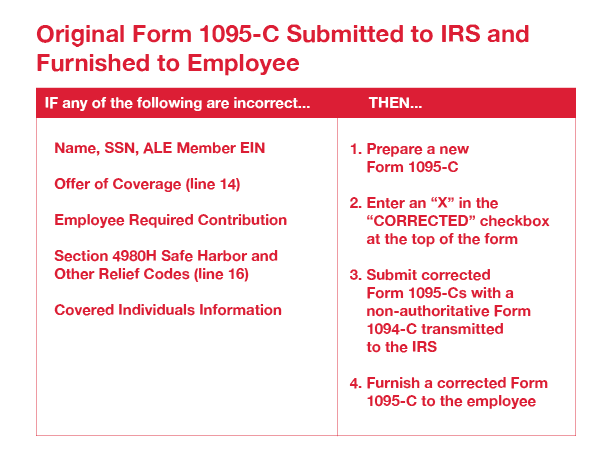

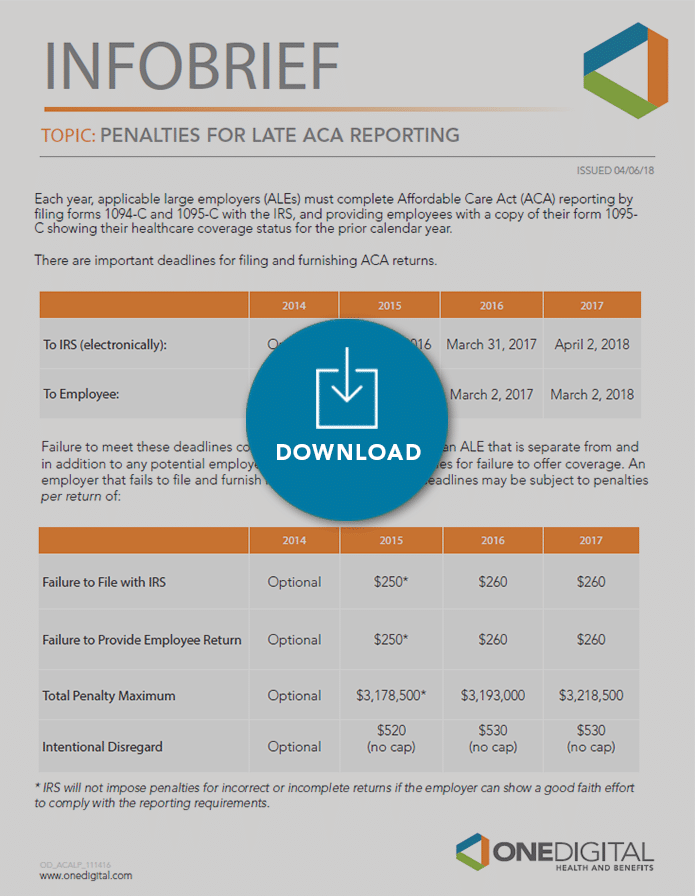

Since the IRS began enforcing the Affordable Care Act (ACA) it has been lenient in its enforcement of the penalties associated with the ACA particularly with regard to late and incorrect Forms 1094C and 1095C This position appears to have changed with regard to the 17 reporting season Late last week and early this week a number of employers received a NoticeForm 1095C is a new form designed by the IRS to collect information about applicable large employers and the group health coverage, if any, they offer to their fulltime employees Employers will provide Form 1095C (employee statement) to employees and file copies, along with Form 1094C (transmittal form), to the IRS Form 1095C isFurnish corrected Forms 1095C to affected individuals as soon as practicable Penalties The IRS penalty for failing to provide a correct employee statement is $100 for each incorrect statement The total penalty for a calendar year is not to exceed $1,500,000

Aca Compliance Filing Deadlines For The 18 Tax Year

Create E File Affordable Care Act Forms

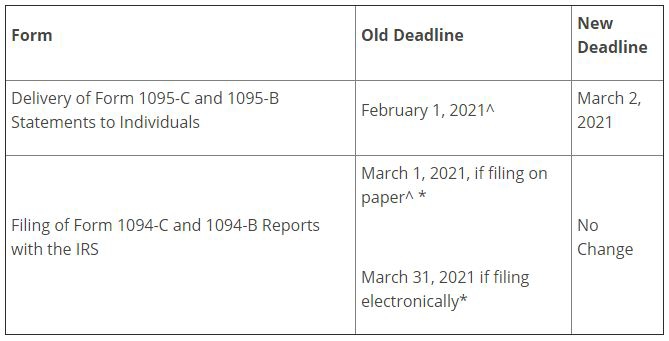

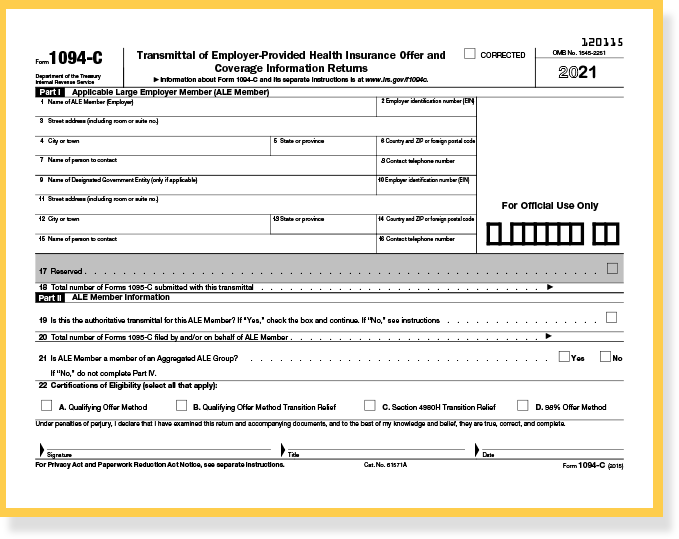

IRS Form 1094C Form 1094C is the transmittal form that accompanies Form 1095C when filing with the IRS each year Together, Forms 1094C and 1095C are used to provide information to the IRS regarding health insurance coverage offered to your fulltime employees and that status of individual employee's enrollment Form 1094C is only sentIRS Forms 1095C, copies of which are submitted to the IRS with IRS Form 1094C, which is a transmittal cover sheet that aggregates the information contained in the Forms 1095C Limited Nonassessment Period A period during which an employee is not counted for the purposes of assessing the nocoverage and the inadequatecoverage penaltiesGenerally, you must file Forms 1094C and 1095C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates For calendar year 18, Forms 1094C and 1095C are required to be filed by , or , if filing electronically

Irs Announces Changes With Aca Reporting Forms And Instructions Onedigital

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

IRS Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Form 1094C is used by Applicable Large Employers (ALEs), or employers that had 50 or more fulltime employees during the calendar year ALEs must file Form 1095C for each of their employees to disclose information about the healthcare coverage and enrollment offered The IRS will determine liability for an ESRP after reviewing the employer's Form 1095C and 1094Cs and employees' individual income tax returns Applicable Large Employers must submit their 1094C and 1095C forms by for employers filing by paper and for employers filing electronically 30Day Rule If 1095Cs (or Bs) are furnished to enrollees within 30 days after the due date (eg, by ) the perreturn penalty is reduced from $250 to $50 per return, and the calendaryear cap is reduced to $500,000 ($175,000 for small entities with gross receipts of not more than $5,)

News Flash September 5 14 Irs Releases Draft Pay Or Play Informat

State Individual Mandates Add To Employer Reporting Responsibilities Foster Foster

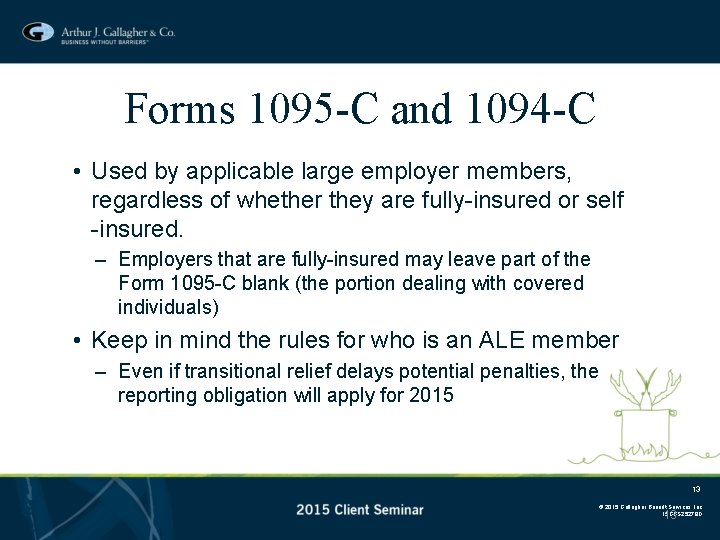

The 1094C and 1095C filings used by Applicable Large Employers along with employee tax returns will be used by the IRS to determine if the employer owes a shared responsibility payment and whether employees are/were eligible for a premium subsidy Any penalties will be calculated and communicated by the IRS in Letter 226J Employers owe the IRS aForm 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax credit The IRS imposes penalties for late filing of Forms 1094C and 1095C or for late furnishing of Forms 1095C under Internal Revenue Code (IRC) Sections 6721 and 6722 These penalties can be huge depending on the number of late Forms 1095C, at a rate of $270 per form for failure to file and an additional $270 per form for failure to furnish for the 19 tax year

2

2

IRS Issuing 1094C/1095C Penalties Alert IRS Issuing Penalties to Employers who Fail to Distribute 1095C Forms to Employees and who Fail to File 1094/1095C Forms with the IRS While IRC 4980H penalties for not offering required ACA health coverage remain in effect, the IRS is beginning to send employers a new set of penalties Employers or other coverage providers that do not comply with the due dates for furnishing Forms 1095B and 1095C (as extended under the rules described above) or for filing Forms 1094B, 1095B, 1094C, or 1095C are subject to penalties under section 6722 or 6721 for failure to timely furnish and file, respectively Also, the filing deadlines were not extended for Forms 1094B, 1095B, 1094C, or 1095C with the IRS, all of which must be filed by , or efiled by The term "filing" means submitting the forms to the IRS, either electronically or through mail Possible Form 1095C NonCompliance Penalties

What To Expect On Form 1094 C 1095 C For 17 Aca Reporting

Aca Jolt Irs Non Filing Fine Up To 550 Per Required 1095 C In Integrity Data

Employers file copies of Forms 1095C with transmittal Form 1094C to the IRS The employer indicates on Form 1094C if it is eligible for alternative (simplified) reporting Employers also use this form to certify that the employer is eligible for transition relief under the ACA "play or pay" rules, if applicable These new IRS forms are Forms 1094C and the 1095C Correctly completing these new IRS forms is mandatory under the ACA and will allow your business to continue operating without unnecessary loss due to fines and penalties Having your Payroll, HR Administration, and Benefits Administration in one system can make the process easier The IRS issued its 16 final instructions for completion of Form 1094C and Form 1095C Under Sections 6056, applicable large employers (ALE) are required to complete Forms 1094C and 1095C annually to report whether the employer has complied with its employer shared responsibility obligations and determine any applicable penalty assessment

Irs Releases Draft Forms And Instructions For 18 Aca Reporting Brinson Benefits Employee Benefits Advisory And Patient Advocacy Firm

21 Aca Reporting Is Due In Early 22 Hr Works

In the final days of 18, the agency started assessing penalties to organizations that failed to file forms 1094C and 1095C with the IRS or furnish 1095C forms to employees under IRC 6721/6722 for the 15 and 16 tax years This appears to be the first time the IRS has issued notices to employers that include ACA penalties under IRC 6721/6722Even if you follow the rules when it comes to the ACA, Form 1094C and Form 1095C, errors in reporting can trigger an ESRP letter and a hefty penaltyForm 1094C is used in combination with Form 1095C to determine employer shared responsibility penalties It is often referred to as the "transmittal form" or "cover sheet" IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement, which relates to the employer shared responsibility/play or pay requirement

Files Clickdimensions Com

2

17 Forms 1094C and 1095C with the IRS For late/nonfurnishing 17 Forms 1095C to employees Penalty If an ALE files/furnishes within 30 days of the due date If the business has gross receipts of more than $5 million, the penalty is $50 per return, with a maximum penalty of $532,000 If the business has gross receipts of $5,000,000 Forms 1094C and 1095C are filed by applicable large employers (ALEs) to provide information that the IRS needs to administer employer shared responsibility penalties and eligibility for premium tax credits, as required under Code § 6056 In addition, ALEs will need to properly file transmittal Form 1094C, along with the Forms 1095C s to avoid incurring penalties In addition to serving as a transmittal form, the ALEs also use Form 1094C to demonstrate compliance with the requirement to offer Minimum Essential Coverage to at least 95% of their fulltime workforce

Irs Releases Draft 19 Aca Reporting Forms And Instructions Sig

1095 C Forms Due To Employees By February 1 Are You Aca Ready Erp Software Blog

Form 1094C is used in combination with Form 1095C to determine employer shared responsibility penalties It is often referred to as the "transmittal form" or "cover sheet" IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement, which relates to the employer shared responsibility/play or pay requirement1094C is the transmittal form that accompanies Form 1095C when filing with the IRS each year Together, Forms 1094C and 1095C are used to provide information to the IRS regarding health insurance coverage offered to your fulltime employees The premium tax credit information necessary to enforce either penalty under IRC section 4980H is not reported anywhere on the Forms 1094C and 1095C Therefore, filing the Forms 1094C and 1095C with the IRS does not start the statute of limitation clock In fact, nothing does!

The Irs Is Issuing Penalties For Not Providing 1095 C Forms By Irs Deadlines Update The Aca Times

Draft 16 Instructions For Form 1094 C 1095 C Released Boomtax

The IRS Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determiningWhen assessing whether an employer may be subject to a shared responsibility penalty, the IRS uses an employer's Forms 1094C and 1095C, as well as employees' income tax returns Based on this information, if the employer does not report an applicable safe harbor and the employee received subsidized coverage, then the letter will be issued IRS announces relief for certain Form 1094/1095 reporting requirements In a similar move as in previous years, the IRS has issued relief from certain Form 1094C and 1095C reporting requirements under the Affordable Care Act relating to employee health plans, as well as relief from certain reportingrelated penalties

2

Irs Extends Deadline For Furnishing Form 1095 C Extends Good Faith Transition Relief Fedeli Group

Penalties for late filing are severe Failure to file information returns will result in an IRS penalty of $260/return with a maximum penalty of $3,218,500 per organization The penalties are levied based on the information provided by employers on their 1094C and 1095C forms Section 4980H (a) A penalty will be levied on an employer if Minimum Essential Coverage (MEC) is not offered to at least 95% of their fulltime employees and if any employee receives a Premium Tax Credit (PTC) through the marketplace If a Form 1094C or 1095C filed electronically is corrected within 30 days of the required filing date, that is, if it is corrected by for 15 filings, the penalty for each violation is reduced to $50 with a maximum penalty of $529,500 per employer

2

For 17 Tax Year The Irs Is Issuing Aca Penalty Letter 5005 A

On the newest 1094C and 1095C forms, the IRS has removed the Qualifying Offer Transitional Relief box Previously, this box was located on Line 22 on both forms On 1094C, option B was labeled as "Reserved" and appeared as Line 14 Code 1L on 1095CThe IRS' efforts have relied exclusively on the Forms 1095C and 1094C submitted by employers for those years Employers use those forms to demonstrate compliance with the mandate Many employers have received letters from the IRS assessing massive penalties related to those years, some penalties into the tens of millions of dollarsNote §6055 reporting via Forms 1094B and 1095B will apply if the employer offered a selfinsured medical plan Employer is subject to potential pay or play penalties (under §4980H) in 21 Employer is subject to ACA reporting (§6055/ §6056 via Forms 1094C and 1095C) for the 21 calendar year that is reported at the

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Affordable Care Act Lessons Learned Ppt Download

These penalties are being administered under IRC 6721/6722 and this is the first year the IRS has begun issuing such penalties The proposed penalty assessments for failing to file (or filing incorrectly) the C forms, or for failing to provide employees with the 1095C form, are indexed each tax year The following link highlights theAuthoritative Transmittal Form 1094C ALE Member or Designated Government Entity (Name and/or EIN) Total number of Forms 1095C filed by and/or on behalf of ALE Member Aggregated ALE Group Membership Certifications of Eligibility Minimum Essential Coverage Offer Indicator

2

Affordable Care Act Reporting Requirements Presented By Winston

Irs Ssa Filing Penalties For Nelcosolutions Com

Aca Deadlines Penalties Extension For 21 Checkmark Blog

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Microsoft Dynamics Gp Year End Update Affordable Care Act Aca Microsoft Dynamics Gp Community

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Irs Announces Relief For Certain Form 1094 1095 Reporting Requirements Mcafee Taft

The Irs Is Issuing New Aca Penalties Against Employers Accounting Today

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Feeling The Heat Sections 6055 And 6056 Reporting

/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Are You Liable For Shared Responsibility Payments Sbma Benefits

Trusaic Aca Complete Reviews 21 Details Pricing Features G2

Irs Delays The Deadline To Furnish The Aca Forms 1095 C And 1095 B To March 2 17 And Extends The Good Faith Transition Relief From Reporting Penalties Trucker Huss

Let S Check Those Forms 1094 C Before Filing With The Irs Lockton Companies

Irs Releases Final Forms And Instructions For 17 Aca Reporting Brinson Compliance Brinson Benefits Employee Benefits Advisory And Patient Advocacy Firm

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

Blog Penalty Relief

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Use This Helpful Aca Checklist For 16 Reporting

Employer Reporting Webinar Forms 1094 C 1095 C Brown Brown Insurance

Compliance Update Forms 1094 C And 1095 C Calcpa Health Trusted Health Plans For Cpas

Affordable Care Act Deadlines Extended For Notices Lexology

15 Forms 1094 B 1095 B 1094 C And 1095 C Benefits Work

Affordable Care Act Form 1095 C Hrdirect

Need To Correct An Irs 1094 C Or 1095 C Form

1094 C 1095 C Software 599 1095 C Software

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Your 1095 C Obligations Explained

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

What Are The Form 1094 C And 1095 C Requirements For Self Insured Health Plans In

Aca Employer Compliance In 6 Easy Steps

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Bryan Cave Leighton Paisner Play Time Is Over Irs Reveals Process For Assessing Aca Penalties

Filled Out 1095 C

What Cpas Need To Know About New Ppaca Forms

Aca Compliance Reporting Morris Reynolds Insurance

2

Missed The 1095 C Deadlines Now What Onedigital

Irs Memo Concludes There Is No Statute Of Limitations For Aca Employer Mandate Penalties Under Internal Revenue Code 4980h Workforce Bulletin

S3 Amazonaws Com

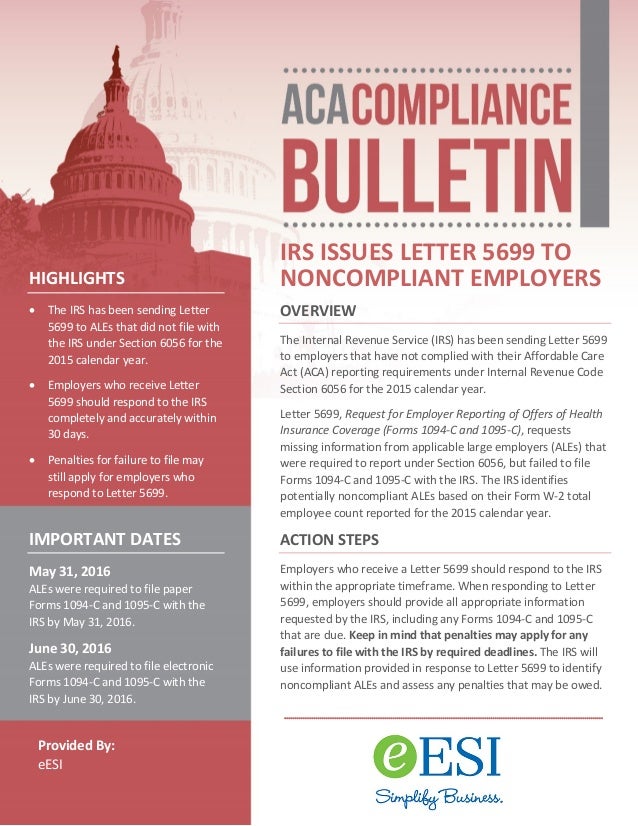

Aca Compliance Bulletin Irs Issues Letter 5699 To Noncompliant Empl

Irs Releases Draft Forms And Instructions For 19 Aca Reporting Default Landing Page Strategic Services Group

18 1095 Deadline Extended From Jan 31 To March 4 Leavitt Group News Publications

2

3

Aca Compliance Filing Irs Forms 1094 C And 1095 C

Form 1095 C Basics Best Practices And Hr Compliance Bernieportal

3

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Your 1095 C Obligations Explained

Sage 100 Contractor U S Aca Forms 1095 C And 1094 C Youtube

Hr Ease

Irs Form 1095 C Codes Explained Integrity Data

Common Mistakes In Completing Forms 1094 C And 1095 C

How To Correct Form 1094 1095 Errors The Cip Group

Everything You Should Know About Irs Letter 5699

Update Employer Penalty And 1094 C 1095 C Reporting

Aca Reporting Penalties Newfront Insurance And Financial Services

Aca Employer Compliance In 6 Easy Steps

3

Free Aca E File Trusaic

Irs Releases Final Forms And Instructions For 19 Aca Reporting Bim Group

The Irs Wants To Know Has Your Company Filed Form 1095 C

Cdn2 Hubspot Net

Affordable Care Act Reporting Update Benefit Minute Psa Insurance And Financial Services

Irs Extends Good Faith Penalty Relief And Due Date For Furnishing 18 Forms 1095 B And 1095 C To Individuals But Not For Filing With The Irs

New Trade Act Quietly Increases Aca Reporting Penalties Ubf

Irs Extends Due Dates For Aca Reporting And Renews Penalty Relief Lexology

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C

The Individual Mandate May Be Going Away Next Year But Employers Are Still On The Hook For 1094c 1095c Reporting Usi Insurance Services

Lockton Com

Irs Finalizing 1094c 1095c Reporting Process Usi Insurance Services

Updated Irs Reporting Requirements Babb Insurance

File Aca 1094 C 1095 C Information With Irs On Time To Avoid Penalties The Aca Times

0 件のコメント:

コメントを投稿